estate trust tax return due date

Limitation on business losses for certain taxpayers repealed for 2018 2019 and 2020 --19-MAY-2020. Due date for third installment of 2022 estimated tax payments.

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

As trustee you have a lot of flexibility in when to submit the first tax return.

. If the Form 1041 deadline slipped your mind or you just realized you need to file there is still time to request an extension. Form 1041. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related.

However for purposes of calculating the distributable net income DNI deduction the trust and estate are treated as separate shares Regs. When filing estate taxes IRS Form 706 is due within nine months of a decedents date of death but filing Form 4768 automatically grants a six-month extension. Due Date For Filing.

If the tax is not paid by the regular due date the extension of time to file is invalid. Form 1120 for C-Corporations 18th April 2022. Form 1120S for S-corporations 15th March 2022.

The tax return for a Sec. Before filing Form 1041 you will need to obtain a tax ID number for the estate. Form 1041 for Trusts and Estates 18th April 2022.

100 Free Tax Filing Only For Simple Tax Returns. A special rule to defer the due date change for C Corporations with fiscal years that end on June 30th defers this change until December 31 2025. Application for Extension for Filing Estate or Trust Tax Return.

For trusts on a fiscal year the trust tax return filing deadline is the 15th day of the fourth month following the close of the tax year. File Confidently With Free Edition. Form 1065 for Partnerships 15th March 2022.

Final deadline to file your 2021 personal tax return if you filed an extension. The upcoming April 15 2021 income tax deadline doesnt only apply to businesses. Extension of Time to File All estates and trusts are granted an automatic six-month extension to file Form M2 if the tax is paid in full by the regular due date.

Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR and 1040-NR for Tax Year 2018 and Tax Year 2019--10-JUL-2020. Final deadline to file your C corporation tax return if you filed an extension. The standard filing deadline remains April 15 April 18 for 2017 due to a weekend and holiday.

A trust or estate with a tax year that ends June 30 must file by October 15 of the same year. Washington estate tax forms and estate tax payment. However you may want to file the final return before that time.

Form 1040 for Individuals 18th April 2022. The first step is to pick a closing date for. 31 rows Generally the estate tax return is due nine months after the date of death.

Enjoy 0 Loan Fees And 0 APR. 645 combined estate and trust appears to be one return in terms of reporting the income and expenses on the Form 1041 tax return. Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. If you wind up an inter vivos trust or a testamentary trust other than a graduated rate estate you have to file the final T3 return and pay any balance owing no later than 90 days after the trusts tax year-end. An estates tax ID number is called an employer identification.

Income Tax Return for Estates and Trusts and Schedule K-1 Beneficiarys Share of Income Deductions Credits etcFor fiscal year file by the 15th day of the fourth month following the tax year close Form 1041. Employee Benefit Plan tax returns are due the last day of the seventh month after the plan year ends. NC K-1 Supplemental Schedule.

It is important to. Form W-2 W3 1099 NEC and 1096 NEC. One of the following is due nine months after the decedents date of death.

13 rows Only about one in twelve estate income tax returns are due on April 15. An estate administrator has the option of either setting the trust up on a calendar. Many charitable trusts and recipients of trusts and estates are required to file Form 1041 by this due date.

The decedent and their estate are separate taxable entities. What is the due date for IRS Form 1041. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income.

C Corporation tax returns will be due the 15th day of the fourth month after the end of their fiscal tax year. An automatic six month extension of time to file the return is available to all estates including those filing solely to elect portability by filing Form 4768 on or before the due date of the. If you wind up a graduated rate estate the tax year will end on the date of the final distribution of the assets.

For example for a trust or estate with a tax year ending December 31 the due date is April 15 of the following year. Owner or Beneficiarys Share of NC. However the new extension deadline is 5½ months from that date or Sept.

The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six months. Beneficiarys Share of North Carolina Income Adjustments and Credits. If the fiscal year end is May 31 the due date is September 15.

For calendar-year file on or before April 15 Form 1041 US. Trust Return Due Date. Get Up To A 4000 Refund Advance With TurboTax.

Link is external 2021. Unlike personal tax returns trust tax returns have more than one due date. Fin CEN 114 FBAR.

Taxpayer Relief for Certain Tax-Related Deadlines Due To Coronavirus Pandemic-- 14-APR-2020. Return extension payment due dates. Final deadline to file your 2021 calendar-year estatetrust tax return if you filed an extension.

The return is required to be filed on or before April 15 if on a calendar year basis and on or before the 15th day of the fourth month following the end of the fiscal year if on a fiscal year basis. Due Date for Estates and Trusts Tax Returns. For trusts operating on a calendar year the trust tax return due date is April 15.

The gift tax return is due on April 15th following the year in which the gift is made. Estate tax forms rules and information are specific to the date of death. Of particular significance in the trusts and estates area is the new extension deadline date for filing Trust and Estate Form 1041.

IRS Form 1041 US. A request for an extension to file the Washington estate tax return and an estimated payment.

Understanding The Estate Tax Return Marotta On Money

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

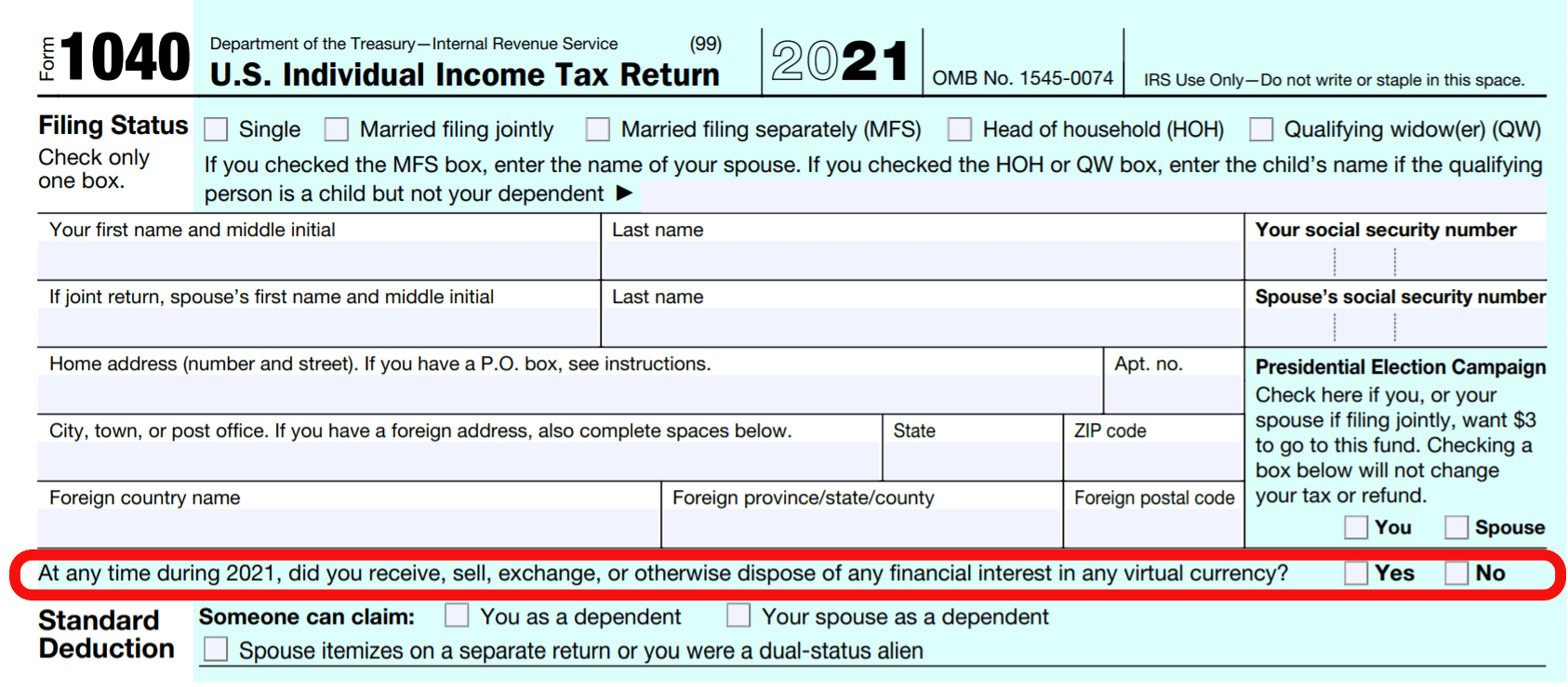

How To Answer The Virtual Currency Question On Your Tax Return

Income Tax Return Filing 2020 Last Date Extended For These Taxpayers The Financial Express

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Taxes Tax Planning Orange County Tax Lawyer Crockett Law Corporation

Irs Form 1041 Filing Guide Us Income Tax Return For Estates Trusts

Philadelphia Estate And Tax Attorney Blog Irs Payment Plan Business Plan Template Free Irs

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition

Fillable Form 1000 2017 Fillable Forms The Covenant Form

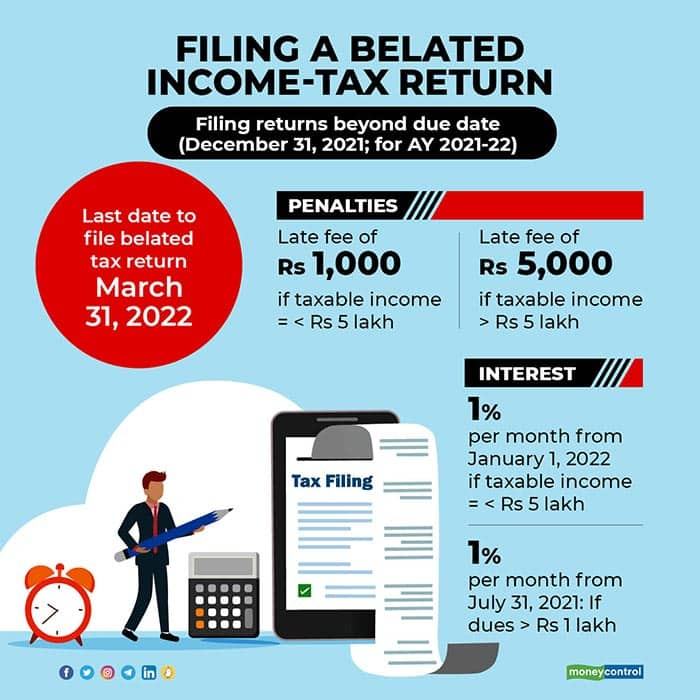

Explained All About Belated Filing Of Income Tax Returns

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Federal Income Tax Deadline In 2022 Smartasset

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Peer Operator Advisory Income Tax Return Filing Grab Ph

What To Do If You Receive A Missing Tax Return Notice From The Irs